Reader Q&A

Best Way To Exit A Winning Vertical Spread

We got a very intelligent question yesterday from a reader over at the outstanding Portfolio Armor Substack. In this case, the reader had just put on a winning vertical spread trade in TSLA and were wondering how to estimate the exit price now that the spread was deep in the money.

The trade in question was a long TSLA 390-395 Call Vertical Expiring on December 27th. This recommendation came out when TSLA was well below the strike and the stock blew above the top strike of the vertical generating an unrealized profit. The reader wanted to know when the vertical spread would trade at 4.50.

The best way to estimate the future value of the vertical is to use a technique called Previewing, and compare the current pricing to various scenarios in the future.

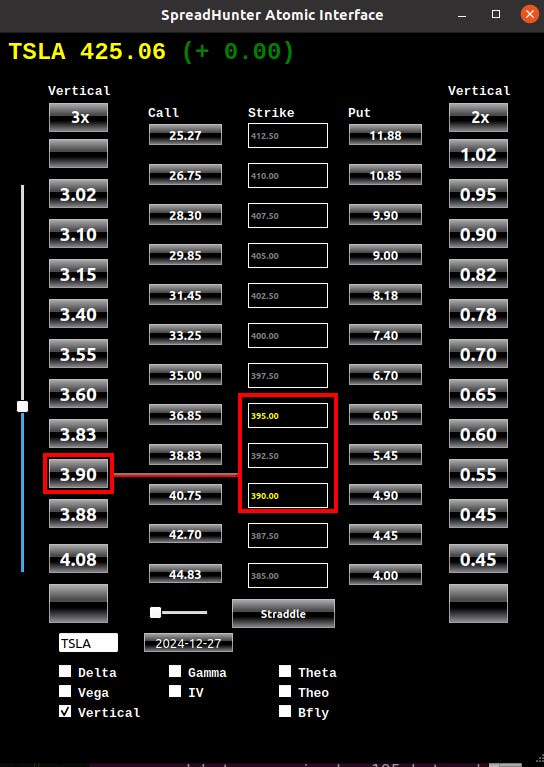

Let’s start off with where the Dec 27 Vertical is trading today, December 13:

As we see in the screenshot, with TSLA trading at about 425- per share, the Call Vertical is quoted at 3.90 at the midpoints. This is still 1.10 away from maximum value of the spread, which will happen if TSLA closes at or above 395.00 at expiration on December 27. In other words, the market is telling us that there is a non-zero chance that TSLA might fall below 395- before then and is marking the price accordingly.

Let’s look at a couple of comparison quotes to get a feel for what might happen to this spread as the clock ticks down toward expiration.

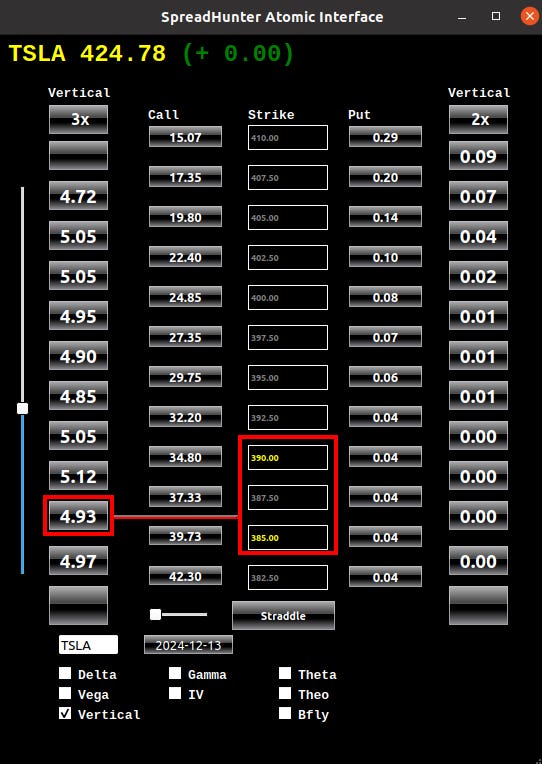

Here is the same spread expiring later this afternoon:

As we see here, the spread midpoint is now quoted 4.93, and is approaching maximum value since we are close to expiration.

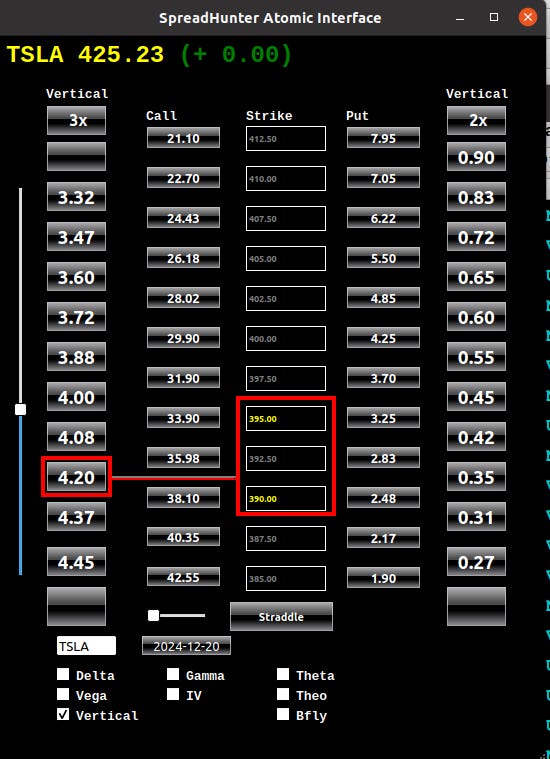

Let’s look at the spread expiring one week from today:

We see that the same spread expiring on December 20 (one week from today), the spread is quoted 4.20, or close to our readers 4.50 target. Another day or two of time decay should bring the spread close to 4.50.

So, to answer the readers question of “what will it take for my spread to hit 4.50”, the answer is that if he or she waits for another 7-8 trading days, that the spread will probably trade for about 4.50 if TSLA stays flat here.

You can estimate the impact of moves in TSLA on the vertical spread price by looking at spreads above and below the 380-385 strikes over the same expiration dates. Note that the spread midpoint prices are a bit erratic because the size of the options in each leg is astronomical (over 43- per contract per leg).

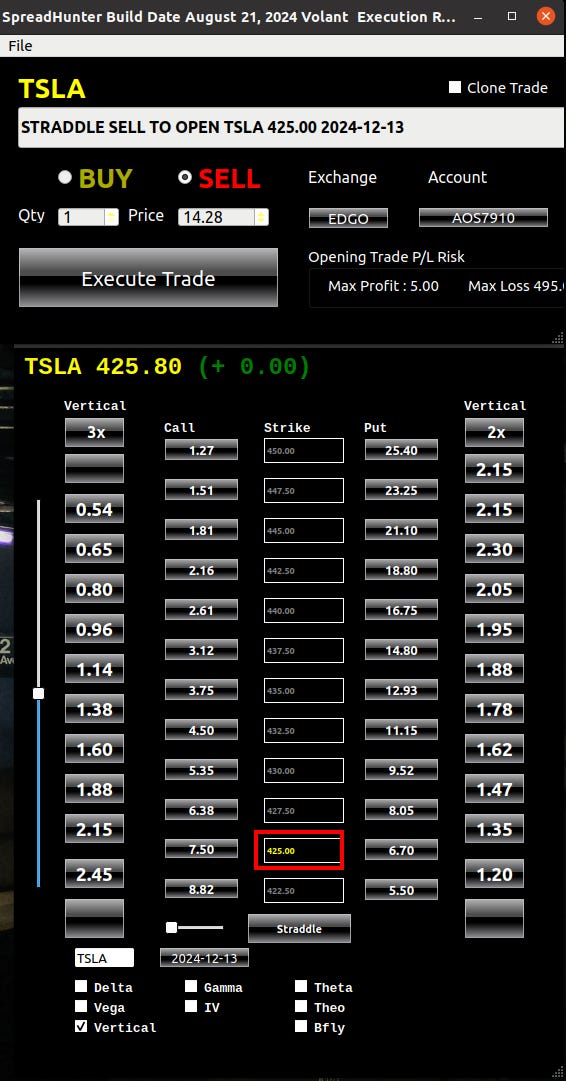

What is a good estimate for the price swings in TSLA stock over this time period? As we saw in previous posts, using the At-The-Money Straddle price offers a very good estimate of the range of the stock going forward. In this case the TSLA Dec 20 425.00 Straddle is quoted at 14.22, which suggests that TSLA will move +/- 7 points over the next week.

As I mentioned in the book The Nuclear Option: Trading To Win WIth Options Momentum Strategies, previewing is a great way to visualize future scenarios without needong to calculate Greeks and theoretical values.

If you have more questions, put them in the comments. To start using SpreadHunter tools to implement your own options trading strategy, open an account here.